O well…

Debit or Credit?

How Visa, Using Card Fees, Dominates a Market

By ANDREW MARTIN

Visa says it does not care how consumers use their debit card, as long as it is a Visa. But for now at least, the company says the only way to ensure that a purchase is routed over the Visa network is to sign.

“When you use your Visa card, you have a chance to win a trip to the Olympic Winter Games,” a new Visa commercial promises.

The commercial does not explain the rules, but the fine print on Visa’s Web site does: nearly all Visa purchases are eligible — as long as the cardholder does not enter a PIN.

Read the whole article from the New York Times, January 5, 2010.

Extended Business Carryback Period

IRS Rev. Proc. 2009-52 provides guidance under Section 13 of the Worker, Homeownership, And Business Assistance Act 2009. Section 13 allows taxpayers to elect to carry back an applicable NOL for a period o 3, 4, or 5 years, to offset taxable income in those preceding taxable years. It applies to NOLs for a taxable year ending after December 31, 2007, and beginning before January 1, 2010. An election must be attached to the appropriate carryback form. Here is sample language from the IRS website:

ABC Company is electing to apply Section 172(b)(1)(H) under Rev. Proc. 2009-52. ABC Company is not a TARP recipient and was not an affiliate of a TARP recipient during 2008 or 2009. We are electing a 4 year carryback period.

The Post Office Closes at 5

This is the last day to pay those real property taxes, charitable contributions, and other deductible expenses in order to have the opportunity to apply them toward income earned in 2009. The general rule, accelerate expenses and defer income, should hold true today.

If possible, review stock positions and take capital losses and gains so that they balance each other. Remember that the general rule is that $3000 of capital losses may be deducted in excess of capital gains.

IRA or Roth IRA contributions for 2009 may be made until April 15, 2010. Consider making your 2010 contributions next Monday! Profit sharing and employer matches for employee 401k contributions may be made until the due date of the related tax return plus extensions.

If you use your automobile for business, make a note of your odometer reading today.

For a recap of other great year end lists, check out Don’t Mess with Taxes, a great blog by Texas journalist, Kay Bell.

Who’s up to date on your Facebook updates?

From American Public Media, Future Tense:

Facebook is about to change. Oh, you’ll still get surprising friend requests from obscure 3rd grade classmates but the site dedicate to public sharing is about to get more private thanks to new privacy settings that will allow you to decide, update by update, who gets to see what you’re doing.

It’s a valuable tool in managing your privacy, at least to a certain degree. At the same time, however, Facebook still has access to all your data and it pays its bills by tailoring advertising to you based on the information you provide. And if you install a third party app to play a game or something, those outside developers have access to your information as well.

Guest: Michael Zimmer, University of Wisconsin

What’s up with IRS Form 944?

IRS Form 944 is an employer’s annual payroll tax return that was designed to reduce the burden of on small employers whose payroll liabilities are $1000 or less annually.

Procedures to opt out of the use of this form and continue using Form 941 were released by the IRS on October 26 (Rev. Proc. 2009-51, I.R.B. 2009-45, October 26, 2009.)

Employers who have previously filed Forms 941 or Form 944 and who want to call to request to opt in or out of filing Form 944 for the current tax year must call the IRS on or before April 1st of the current tax year (e.g., April 1, 2010, for tax year 2010 returns). Employers who want to write to request to opt in or out of filing Form 944 for the current tax year must have their written correspondence postmarked on or before March 15th of the current tax year (e.g., March 15, 2010, for returns for tax year 2010).

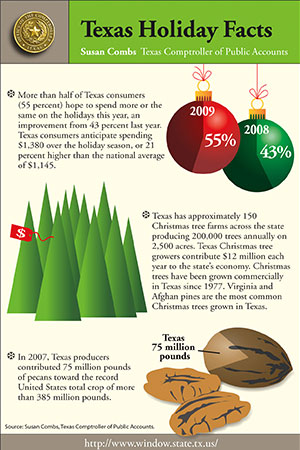

Texas Holiday Facts

During the holiday season, people across our state will gather together and celebrate with friends and family to exchange gifts, offer thanks and reflect on the past year. Many Texans are also expected to buy Christmas trees, bake holiday treats or hit the roads to travel. To commemorate this special time of year, Texas Comptroller Susan Combs has compiled some festive holiday facts about our state and its economy related to the season.

• Texas has approximately 150 Christmas tree farms across the state producing 200,000 trees annually on 2,500 acres. Texas Christmas tree growers contribute $12 million each year to the state’s economy. Christmas trees have been grown commercially in Texas since 1977. Virginia and Afghan pines are the most common Christmas trees grown in Texas.

• In Houston, the city saved $185,000 in landfill costs by recycling 5,800 tons of tree waste from 47,000 homes from October 2007 to September 2008. Seventy-nine tons of this tree waste was from Christmas tree recycling.

• In 2007, Texas producers contributed 75 million pounds of pecans toward the record United States total crop of more than 385 million pounds.

• The Neiman Marcus Christmas Book was first published in 1926. Neiman Marcus is headquartered in Dallas.

• The Collin Street Bakery in Corsicana has been baking the world-famous DeLuxe fruitcake since 1896, the recipe for which was brought over from Wiesbaden, Germany. The bakery ships its Texas fruitcakes, pecan cakes and other delicious pastries to 196 countries.

• In 2008, 5 million Texans traveled during the Christmas and New Year’s season, with 4.5 million traveling by car. Only California had more holiday travelers.

• According to the U.S. Census Bureau, three places in the country are named after the main course of Christmas dinner: Turkey, Texas, was the most populous in 2008, with 456 residents, followed by Turkey Creek, La. (361) and Turkey, N.C. (272).

• According to climate data gathered over the years, Abilene, Lubbock and Wichita Falls have a 3 percent chance of having a white Christmas, and Amarillo has a 7 percent chance of having snow on Dec. 25. The other major cities in Texas have nearly zero chance of a white Christmas.

• More than half of Texas consumers (55 percent) hope to spend more or the same on the holidays this year, an improvement from 43 percent last year. Texas consumers anticipate spending $1,380 over the holiday season, or 21 percent higher than the national average of $1,145.

• Three in four Texas consumers plan to use cash, checks or debit cards to pay for their gifts, compared to 65 percent nationwide. Only 23 percent of Texans expect to use credit cards.

• More than 60 percent of Texans expect to shop at discount/value department stores and 50 percent plan to shop via the Internet.

• Gift cards are expected to be the top gift for the sixth year in a row, with 67 percent of Texas consumers planning to buy an average of six gift cards for presents this year.

House “Extenders” Package Unveiled

On December 7, House Ways and Means Committee Chair Charlie Rangel (D-NY) formally introduced H.R. 4213, the “Tax Extenders Act of 2009.” The 110-page measure, which would extend for one year 40-plus provisions that are set to expire at the end of this year, would be paid for by new foreign account tax compliance measures, and taxing “carried interest” as ordinary income. The bill is slated to be considered by the House Rules Committee on December 8, and then proceed directly to the House floor.

Individual provisions that would get a one-year lease on life are the election to claim an itemized deduction for state and local general sales taxes, the additional standard deduction for real property taxes, and the above-the-line deductions for qualified tuition costs and for schoolteachers.

Christmas Bargains

The private-sale sites — a misnomer because most of these so-called exclusive sites are open to anyone who signs up — have become a thriving corner of online commerce. Sites using the same “while supplies last” approach have sprung up recently to sell home furnishings, beauty products and travel packages.

Private-sale sites are attracting brand-name investors. Kleiner Perkins Caufield & Byers, the venture capital firm that backed Google and Amazon.com, invested on Wednesday in One Kings Lane, which sells home décor. Gilt Groupe raised $55 million from Matrix Partners and General Atlantic, and Rue La La’s parent company was recently acquired byGSI Commerce for $180 million.

It works for the fashion industry, too, because as the economy slumped, stores deeply cut inventory, which left some designers with excess stock, depending on their production calendars. Some high-end brands view the sites as a place to unload inventory without sullying their image by having their merchandise appear on Overstock.com or on the racks at Filene’s Basement. The members-only Web sites also ensure that search engines will not locate and list the discounted products.

Debt Cancellation “Insurance”-Not as Good as it Sounds

On Marketplace; Tess Vigeland interviewed Bob Sullivan, who covers Internet scams and consumer fraud for MSNBC.com. Listen to the show or read the transcript and learn about offers by credit card companies to pay your balance if you are laid off, injured, or fired, and how expensive they can be.