What happens when you raise the minimum wage in a down economy?

What happens when you raise the minimum wage in a down economy?

www.nytimes.com

The IRS has finally announced an official start date for the 2014 filing season: It will start accepting returns on Jan. 31. This date is 10 days later than the originally planned starting date of Jan. 21. “The late January opening gives us enough time to get things right with our programming, testing, and systems validation,” said Acting IRS Commissioner Danny Werfel in a press release. This process involves programming, testing, and deploying the more than 50 IRS systems that are needed to handle nearly 150 million tax returns.

The IRS has finally announced an official start date for the 2014 filing season: It will start accepting returns on Jan. 31. This date is 10 days later than the originally planned starting date of Jan. 21. “The late January opening gives us enough time to get things right with our programming, testing, and systems validation,” said Acting IRS Commissioner Danny Werfel in a press release. This process involves programming, testing, and deploying the more than 50 IRS systems that are needed to handle nearly 150 million tax returns.

Read more: Journal of Accountancy

Candy maker, Kirk Vashaw, of Spangler Candy Company, the maker of Dum Dums lollipops states that he could pay no taxes (zero tax rate!) and have no regulations and would still not be able to compete with foreign producers of candy because of the Farm Bill’s price supports for sugar. This price support costs the company $15,000 per day. Hear Zoe Chace’s report for Planet Money. Read the Farm Bill.

Candy maker, Kirk Vashaw, of Spangler Candy Company, the maker of Dum Dums lollipops states that he could pay no taxes (zero tax rate!) and have no regulations and would still not be able to compete with foreign producers of candy because of the Farm Bill’s price supports for sugar. This price support costs the company $15,000 per day. Hear Zoe Chace’s report for Planet Money. Read the Farm Bill.

The Wall Street Journal reports that the IRS and the Department of Labor (DOL) are increasing the pressure on employers to properly classify their workers through payroll audits. A goal has been set to investigate 6,000 employers. The authors write:

The U.S. Treasury estimates that forcing employers to properly classify their workers—while tightening so-called “safe harbor” rules that provide them with leeway in determining who is and isn’t an employee—would yield $8.71 billion in added tax revenue over the next decade.

Tax-Free Scholarships and Fellowships

Tax-Free Scholarships and Fellowships

If and to the extent your scholarship or fellowship does not meet the requirements described earlier, it is taxable and must be included in gross income. You can use Worksheet 1–1, Taxable Scholarship and Fellowship Income (pg 6) to figure the tax-free and taxable parts of your scholarship or fellowship.

Many employers prefer to classify employees as contractors to avoid paying payroll taxes and employee benefits. If the IRS , state employment agency, or the Department of Labor (DOL) audits a taxpayer and determines that employees have been miss classified as contractors, the employer may have to pay the employees’ shares of taxes, including estimated income tax, plus the employer share of payroll taxes, interest, and penalties. In addition there is a special six year statute of limitations rather than the normal three year limit as to how far back the IRS can asses additional tax.

The IRS Voluntary Classification Settlement Program (VCSP) as described in Announcement 2012-45 offers employers the opportunity to reclassify their contractors as employees and limit exposure to additions to tax, penalties and interest. Announcement 2012-46 temporarily expands the VCSP through June 30, 2013, to employers that failed to file Forms 1099 for their contractors.

Here’s a good article about the VCSP: Get Your Worker Reclassification Relief While It Lasts

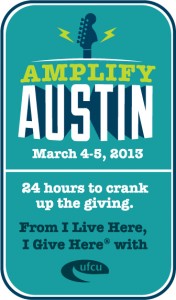

Join the first community wide giving festival through Amplify Austin.

Join the first community wide giving festival through Amplify Austin.

Visit this website (AmplifyATX.org) during Amplify Austin Day, which starts at 7pm, March 4 and ends 7pm, March 5.

At that time, this website will be transformed into a giving site; you’ll be able to search by the name of the nonprofits you love or the causes you’re passionate about.

You will have a greater impact by giving through this website on Amplify Austin Day because our sponsors have created an incentive pool to enhance your donations, and prizes of $1,000 will be given hourly to the nonprofits that garner the most dollars or donors.

On Amplify Austin Day, we are giving back to the city we love. Join us!

Below are two business models for the sale and distribution of fresh, organic baby food.

From their website: Kelly Grant and Noelle Newby founded The Baby Kitchen out of a desire to bring whole, healthy nutrition to our city’s youngest eaters.

They provide incredibly delicious, healthy baby food without all the additives and hidden ingredients. Their food is prepared fresh, then frozen immediately into one-ounce portions that enable you to thaw only what your baby will eat, so there is never any waste from unfinished jars. All food is handmade to order in a professional commercial kitchen. Small batches ensure quality and consistency. And for your convenience, The Baby Kitchen delivers food to your home! They purchase from local Austin are farmers whenever possible.

Freed Foods, which was founded as Freed Foods LLC in 2009, develops a line of dehydrated baby foods called NurturMe. The organic, gluten-free food is sold in serving-size pouches and rehydrated with water, baby formula or mother’s milk, according to the company’s website.