Children tend to be picky eaters and for most of us this only means a little wasted food and some frustration at the dinner table. But what about the parents who cannot afford to throw away food? The working poor who must stretch to make ends meet often have the same nutrition goals for their children but lack the financial resources to introduce their children to new foods and flavors. Statistics show that children must be given a new food 8-15 times before it will be accepted. Imagine how much discarded food that amounts to in a week, a month. Caitlin Daniel reinforces the idea that many parents share the same health desires for their children in her article, A Hidden Cost to Giving Kids Their Vegetables and offers possible ways that schools and organizations may help support a healthy lifestyle for all.

Children tend to be picky eaters and for most of us this only means a little wasted food and some frustration at the dinner table. But what about the parents who cannot afford to throw away food? The working poor who must stretch to make ends meet often have the same nutrition goals for their children but lack the financial resources to introduce their children to new foods and flavors. Statistics show that children must be given a new food 8-15 times before it will be accepted. Imagine how much discarded food that amounts to in a week, a month. Caitlin Daniel reinforces the idea that many parents share the same health desires for their children in her article, A Hidden Cost to Giving Kids Their Vegetables and offers possible ways that schools and organizations may help support a healthy lifestyle for all.

Spend More Now, Save In The Future

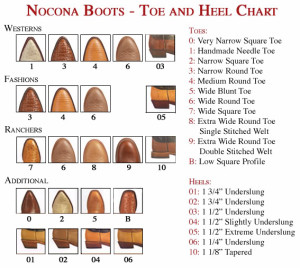

Ever stood in the store comparing two items; the one you truly want and the one that is similar but much less money? Ever considered that if you buy the more expensive, higher-quality version you might have it for years to come and not need to invest more at a later date? Carl Richards, in his article, Spend the Money for the Good Boots, and Wear Them Forever for the New York Times, Your Money section gives a very compelling argument for this theory. Definitely worth consideration the next time your gut says, “spend the money.”

Ever stood in the store comparing two items; the one you truly want and the one that is similar but much less money? Ever considered that if you buy the more expensive, higher-quality version you might have it for years to come and not need to invest more at a later date? Carl Richards, in his article, Spend the Money for the Good Boots, and Wear Them Forever for the New York Times, Your Money section gives a very compelling argument for this theory. Definitely worth consideration the next time your gut says, “spend the money.”

Just Who Are You Paying?

How many recurring charges are on your credit card at the moment? You may be surprised. A new service, Trim, will scan your bills, produce a list of these payments and cancel ones you wish to no longer utilize. This is a free service from Trim as they attempt to build a client base for their personal finance assistance business. Even if you choose not to employee Trim, taking a look at their ranked, most common charges list can be helpful and may inspire you to take the initiative to keep more money in your own pocket.

How many recurring charges are on your credit card at the moment? You may be surprised. A new service, Trim, will scan your bills, produce a list of these payments and cancel ones you wish to no longer utilize. This is a free service from Trim as they attempt to build a client base for their personal finance assistance business. Even if you choose not to employee Trim, taking a look at their ranked, most common charges list can be helpful and may inspire you to take the initiative to keep more money in your own pocket.

Cutting Off Those Recurring Charges You Forgot About

The Dog Ate My Tax Receipts?

Every year people spend hours searching madly for those few missing receipts that will substantiate a tax deduction. An IRS audit is a real fear in the United States, one that is portrayed in television shows as a horrific experience. But did you know that receipts aren’t always a requirement when proving your deductible expenses? Thanks to past Broadway pioneer George M. Cohan, who paid in cash and fought the system when they denied his claims, we have the Cohan Rule. Not the easiest rule to use, you might wind up in court, but good to know in case you ever end up in this situation. Still, probably better to just keep saving your receipts.

Every year people spend hours searching madly for those few missing receipts that will substantiate a tax deduction. An IRS audit is a real fear in the United States, one that is portrayed in television shows as a horrific experience. But did you know that receipts aren’t always a requirement when proving your deductible expenses? Thanks to past Broadway pioneer George M. Cohan, who paid in cash and fought the system when they denied his claims, we have the Cohan Rule. Not the easiest rule to use, you might wind up in court, but good to know in case you ever end up in this situation. Still, probably better to just keep saving your receipts.

No Receipts For IRS? Key Tax Case Says They’re Optional

Join The Crowd

Ever seen the internet ad for ThingCharger? A current, large-scale crowd-funding campaign that promises a space saving, re-charge station for all kinds of electronic devices. These offers appear in your inbox and all over the internet, urging you to share your wealth for inventive ideas and charitable causes. On the opposite side of the spectrum from funds seeking venture capital, are sites such as YouCaring, an online compassionate crowd-funding community. Check it out today and see all the ways you can make a difference in the world!

Ever seen the internet ad for ThingCharger? A current, large-scale crowd-funding campaign that promises a space saving, re-charge station for all kinds of electronic devices. These offers appear in your inbox and all over the internet, urging you to share your wealth for inventive ideas and charitable causes. On the opposite side of the spectrum from funds seeking venture capital, are sites such as YouCaring, an online compassionate crowd-funding community. Check it out today and see all the ways you can make a difference in the world!

Want to start your own crowd funding site? Try this article.

19 Psychological Tactics for Successful Crowdfunding Campaigns

These Shoes Were Made For Walking

You may remember this post from July, Bureaucracy, Autocracy, Holacracy? Online shoe retailer Zappos was ditching a traditional business plan for the more free-form governance known as holacracy. In theory, the plan offered each employee an equal say in various parts of the business. Flash forward to January 2016 where employees have left the company in droves due to this new found “freedom.” The Zappos Exodus Continues After a Radical Management Experiment.

You may remember this post from July, Bureaucracy, Autocracy, Holacracy? Online shoe retailer Zappos was ditching a traditional business plan for the more free-form governance known as holacracy. In theory, the plan offered each employee an equal say in various parts of the business. Flash forward to January 2016 where employees have left the company in droves due to this new found “freedom.” The Zappos Exodus Continues After a Radical Management Experiment.

The New Slang

Are you up-to-date and in-the-know? John Brandon for INC.com advises that the words you’re using may reveal more about your generational age than you thought. 8 Words That Totally Reveal You Are Not a Millennial For those working in offices full of millennials, you may want to watch your language, JK. Guess it’s time to learn the new slang, 15 Words and Phrases Millennials Use but No One Else Understands and be right on, no wait, on fleek.

Are you up-to-date and in-the-know? John Brandon for INC.com advises that the words you’re using may reveal more about your generational age than you thought. 8 Words That Totally Reveal You Are Not a Millennial For those working in offices full of millennials, you may want to watch your language, JK. Guess it’s time to learn the new slang, 15 Words and Phrases Millennials Use but No One Else Understands and be right on, no wait, on fleek.

How Do You Worship?

When was the last time you asked a new friend where they attend church? Or even offered your place of worship as an option to a colleague? As America has become increasingly secular, church is not the common ground it once was, but religiosity and the need for community and personal transformation remain.

When was the last time you asked a new friend where they attend church? Or even offered your place of worship as an option to a colleague? As America has become increasingly secular, church is not the common ground it once was, but religiosity and the need for community and personal transformation remain.

Mark Oppenheimer for the New York Times shares a look into the world of CrossFit, the popular workout program and the ways in which it compares to the ritual of church, citing a study by Harvard Divinity School Students, How We Gather. CrossFit As Church?!

When Some Turn to Church, Others Go to CrossFit

Read the full article and then consider, are you still a regular church attender or have you found other ways in your community to join with others, serve and find personal fulfillment?

Important Tax Extenders And Other Provisions

As the 2015 tax season draws to a close, we wanted to share an article from Maxwell, Locke and Ritter, LLC about the Tax extenders and provisions that have been made permanent by the passing into law of the Protecting Americans From Tax Hikes (PATH) Act of 2015.

As the 2015 tax season draws to a close, we wanted to share an article from Maxwell, Locke and Ritter, LLC about the Tax extenders and provisions that have been made permanent by the passing into law of the Protecting Americans From Tax Hikes (PATH) Act of 2015.

Never hurts to know all the ways you are eligible to save on your taxes! If you need more personalized service or have questions, give me a call. Debra Newby Watkins, CPA, 512 484 8016.

Property Taxes Best Practices

Should I pay my property taxes by the end of the year? That all depends…

Should I pay my property taxes by the end of the year? That all depends…

The general rule is to always take a deduction (pay your property taxes) every year. However, if the total of your itemized deductions is below the standard deduction available to you, “Doubling-up” on your property taxes can afford you a way to keep your standard deduction. Doubling up means paying two years of property taxes at once and then skipping a year.

For example: Suzii is a single taxpayer whose actual property taxes are $6000. She does not donate to charity. As a single person, her standard deduction for 2015 is $6,300. This means, if she has no itemized deductions, she can still reduce her taxable income by $6,300. If she pays her taxes in December, she loses that deduction because her property taxes are less than the standard deduction.

However, if she pays her 2015 taxes in January 2016 and her 2016 taxes by December 2016, her itemized deductions on her 2016 return will exceed the standard deduction and she will get the benefit of an additional reduction of $5,700.

If funds to pay your taxes are held in escrow by your mortgage company, make sure to instruct the company on when they should be paid. Every year check to see if the equity in your property exceeds 20% of the home’s value. Once you reach this mark, the mortgage company can no longer require you to escrow funds and must release any money held in that account to you. You will also by released from making mortgage insurance premium payments.

When purchasing a new home, do not depend on the title company to file your homestead exemption with the appraisal district. Always verify that you are receiving that exemption, as this will affect your property taxes.

As part of the homestead exemption, any 65 year old home owner who lives in the residence, may have their property taxes frozen, If the qualifying homeowner dies, the surviving spouse may continue to receive the exemption if the surviving spouse is age 55 or older at the time of death and lives in and owns the home. This requires an application for the exemption to continue.

There are other exemptions available to disabled persons and veterans, which may also help as you assess the best way to pay your property taxes. For more on these topics visit:

http://comptroller.texas.gov/taxinfo/proptax/exemptions/disabledvet_faq2.html

Keep in mind, that no matter how you choose to finance your property taxes, they are an important part of home ownership and it pays to know all the facts in order to best utilize your money. Have questions? Contact me, Debra Newby Watkins, CPA at 512 484 8016.