2020 was a wild year. Many collected unemployment, received government stimulus checks, and worked from home, which brings a multitude of questions as tax filing season approaches. Tara Siegel Barnard for the New York Times offers answers to the most pressing tax inquiries and shares tips on how to save money. From teachers to retirees to charitable giving and student loans, she covers the bulk of current issues when filing your return. How the Pandemic Has Changed Your Taxes Need more help? Contact Debra at 512 484 8016.

Category: Federal Income Tax

Tax Time is Coming Soon!

It’s time to start gathering forms and data for your 2020 tax returns, if you haven’t already. This time of year you may have many questions about your taxes, but one of the most important things to monitor is your withholding. Ever had a surprise tax bill that caused you financial hardship? The best way to avoid this is by checking your withholding every year. For more information on the right amount for you based on various factors, visit https://www.irs.gov/pub/irs-pdf/p5349.pdf and try their Withholding Estimator today! For all your other tax questions contact me, Debra Newby Watkins, CPA, 512 484 8016.

It’s time to start gathering forms and data for your 2020 tax returns, if you haven’t already. This time of year you may have many questions about your taxes, but one of the most important things to monitor is your withholding. Ever had a surprise tax bill that caused you financial hardship? The best way to avoid this is by checking your withholding every year. For more information on the right amount for you based on various factors, visit https://www.irs.gov/pub/irs-pdf/p5349.pdf and try their Withholding Estimator today! For all your other tax questions contact me, Debra Newby Watkins, CPA, 512 484 8016.

Selling Marijuana, Don’t Forget to Pay Your Taxes

The IRS has dedicated a page on its website to Marijuana sales. Many states have approved the drug for medical uses and some for recreational use, but banks are still discouraged from doing business with these dispensaries and transactions are often made in cash. Even though, just as other consumables, marijuana is subject to taxation and the IRS wants to make it clear to businesses what is expected for paying taxes.

The IRS has dedicated a page on its website to Marijuana sales. Many states have approved the drug for medical uses and some for recreational use, but banks are still discouraged from doing business with these dispensaries and transactions are often made in cash. Even though, just as other consumables, marijuana is subject to taxation and the IRS wants to make it clear to businesses what is expected for paying taxes.

From the site: “The IRS understands this is a new and growing industry and provided frequently asked questions about record keeping, cash payment options, large cash amounts, and other related topics to help promote voluntary compliance in the industry,” said the IRS. “In addition to this page, the IRS also offers a wealth of general small business guidance and resources on IRS.gov.” Want to know more? Visit https://www.accountingtoday.com/news/irs-adds-marijuana-industry-page-to-website

Discount Shopping at What Cost

Most people have shopped in a dollar store. They are very prevalent and often in places that lack other types of businesses. Even though these stores appear to serve needs for those with little access to retail, a veil of crime and violence hangs over many of the locations in urban areas. With low cost operating plans, these stores may staff only two employees at a time and lack hired security.

Most people have shopped in a dollar store. They are very prevalent and often in places that lack other types of businesses. Even though these stores appear to serve needs for those with little access to retail, a veil of crime and violence hangs over many of the locations in urban areas. With low cost operating plans, these stores may staff only two employees at a time and lack hired security.

The True Cost of Dollar Stores

Teach Music Lessons Online

Over the last few months we’ve all adjusted to utilizing Zoom and other online meeting platforms on a daily basis. From business meetings to book clubs, an array of groups have successfully moved their work and socializing online. What about teaching private lessons? Kathy Kristof for the Los Angeles Times reviews Lessonface, an Ap aimed at music teachers of all instruments. Registration is free and commissions/fees are low, 4% for your current students or 15% if they recruit them for you. Check out more about Lessonface here: Review: There’s money to be made teaching music or acting on an app.

Over the last few months we’ve all adjusted to utilizing Zoom and other online meeting platforms on a daily basis. From business meetings to book clubs, an array of groups have successfully moved their work and socializing online. What about teaching private lessons? Kathy Kristof for the Los Angeles Times reviews Lessonface, an Ap aimed at music teachers of all instruments. Registration is free and commissions/fees are low, 4% for your current students or 15% if they recruit them for you. Check out more about Lessonface here: Review: There’s money to be made teaching music or acting on an app.

Midwest Retirement Plans

There are many large companies that brag of their attraction to America’s elite and how the states offer great places for families to live and raise their children. Some even boast of more women as part of the workforce than many other states but do any of these reasons explain why, as retirement plans everywhere have been reduced, Iowa and Minnesota remain on top? Andrew Van Dam for the Washington Post considers these questions and more in, The surprising reasons these Midwest states are the last bastion of retirement plans.

There are many large companies that brag of their attraction to America’s elite and how the states offer great places for families to live and raise their children. Some even boast of more women as part of the workforce than many other states but do any of these reasons explain why, as retirement plans everywhere have been reduced, Iowa and Minnesota remain on top? Andrew Van Dam for the Washington Post considers these questions and more in, The surprising reasons these Midwest states are the last bastion of retirement plans.

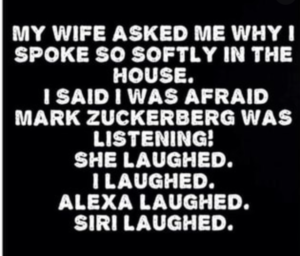

Who’s Laughing Now

Remember when cameras began to appear everywhere in public? Much like the sentiment from Orwell’s novel 1984, “Big brother is watching you,” our daily routines were recorded and occasionally even private moments were caught on film.

Remember when cameras began to appear everywhere in public? Much like the sentiment from Orwell’s novel 1984, “Big brother is watching you,” our daily routines were recorded and occasionally even private moments were caught on film.

Now the world is listening. If this worries you, Stuart A. Thompson and Freaked Out? 3 Steps to Protect Your Phone. From simply turning off location services in ap to using the Privacy ProVPN ap, you can greatly reduce what companies and trackers are able to see and hear.

The More You Buy, the More You Save?

![]() Credit cards come with all types of rewards currently, but do these programs actually help those with more money? Aaron Klein for the Los Angeles Times explains that since luxury, high-end credit cards come with higher swipe fees (the money charged to merchants every time a card is used), those with more money to spend with these types of credit see a much higher benefits and cost merchants more. He goes as far as suggesting that Congress consider legislation for rewards cards or make these perks taxable income.

Credit cards come with all types of rewards currently, but do these programs actually help those with more money? Aaron Klein for the Los Angeles Times explains that since luxury, high-end credit cards come with higher swipe fees (the money charged to merchants every time a card is used), those with more money to spend with these types of credit see a much higher benefits and cost merchants more. He goes as far as suggesting that Congress consider legislation for rewards cards or make these perks taxable income.

Opinion: How credit card companies reward the rich and punish the rest of us

Paying Taxes on Crypto Currency?

Do you owe taxes on crypto currency? Chances are you’re safe if you have no idea what that is, although some parents were unaware that their high-school and college aged children were trading in Bitcoin. The IRS is currently cracking down on tax evaders with digital holdings through two versions of a warning letter. The first implying the tax payer may have no knowledge of these accounts, and the second enforcing a deadline for recipients to disclose all of their crypto transactions or risk legal recourse. Accounting Today suggests the best ways to handle these tax situations based on the type of letter received in the article, Crypto tax avoiders face IRS roulette: Fess up or try to hide .

Do you owe taxes on crypto currency? Chances are you’re safe if you have no idea what that is, although some parents were unaware that their high-school and college aged children were trading in Bitcoin. The IRS is currently cracking down on tax evaders with digital holdings through two versions of a warning letter. The first implying the tax payer may have no knowledge of these accounts, and the second enforcing a deadline for recipients to disclose all of their crypto transactions or risk legal recourse. Accounting Today suggests the best ways to handle these tax situations based on the type of letter received in the article, Crypto tax avoiders face IRS roulette: Fess up or try to hide .

Hurry Up and Do Nothing

In our current state of technology overload and the expectations of busyness, we’ve seemingly forgotten our need for quiet and calm. New studies are showing that our bodies need this time to rest, reconnect, and even become more creative. The New York Times article, The Case for Doing Nothing recommends finding the state of “Niksen,” a Dutch word meaning to do nothing. Keeping our bodies in motion and our brains occupied may feel productive but often leads to exhaustion and a reduced capacity to work efficiently. Turns out that we actually need extreme down time, or as they say in the article, boredom. Give it a try! Take an afternoon to sit and daydream, go to the park and people watch, sit on the couch and imagine, then see how you feel afterward.

In our current state of technology overload and the expectations of busyness, we’ve seemingly forgotten our need for quiet and calm. New studies are showing that our bodies need this time to rest, reconnect, and even become more creative. The New York Times article, The Case for Doing Nothing recommends finding the state of “Niksen,” a Dutch word meaning to do nothing. Keeping our bodies in motion and our brains occupied may feel productive but often leads to exhaustion and a reduced capacity to work efficiently. Turns out that we actually need extreme down time, or as they say in the article, boredom. Give it a try! Take an afternoon to sit and daydream, go to the park and people watch, sit on the couch and imagine, then see how you feel afterward.